Essential Financial Metrics For Business Owners

It all begins with an idea.

Running a business is no small feat, and keeping track of key financial metrics is essential to your success. These metrics provide the insights you need to make smarter decisions, anticipate challenges, and drive growth.

Below, we break down five crucial financial metrics every business owner should monitor and how each plays a role in your company’s health.

1. Cash Flow

Cash flow is the backbone of your business. It tracks the movement of money in and out, showing whether you have enough to cover daily expenses. Positive cash flow indicates that your business is thriving, while negative cash flow may signal potential trouble ahead.

Tips for Staying Positive:

• Regularly review invoices to ensure they’re paid on time

• Cut down unnecessary expenses that eat into your profits

• Create a cash flow forecast to predict periods of shortages and surpluses

Effective cash flow management allows you to make informed decisions about investments and daily operations. For strategic guidance tailored to your needs, CFO advisory services can provide a clearer picture and help maintain financial stability.

2. Gross & Net Profit Margins

Your gross and net profit margins reveal how efficiently your business is operating. Gross profit margin measures the revenue remaining after covering production costs, while the net profit margin shows the remaining profit after deducting all expenses.

The Formula:

• Gross Profit Margin: (Revenue - Cost of Goods Sold) ÷ Revenue

• Net Profit Margin: Net Income ÷ Revenue

A net profit margin of 10% is often considered a healthy level, although it varies by industry. Regularly monitoring these metrics helps you identify inefficiencies and areas for optimization, such as reducing production costs or lowering overhead. If you’re scaling your business, consider leveraging fractional CFO services to support your growth. These experts ensure your profitability aligns with long-term goals.

3. Customer Acquisition Cost (CAC)

Spending money to acquire customers is inevitable, but overspending can drain profits. CAC measures the cost of acquiring each customer.

How to Calculate It:

• CAC = Total Marketing and Sales Costs ÷ Number of New Customers Acquired

Ways to Reduce CAC:

• Focus on retaining existing customers, which costs less than acquiring new ones.

• Optimize your marketing efforts by identifying the most cost-effective channels.

• Test different strategies to determine which one generates the most ROI

By monitoring CAC, you not only optimize your marketing spend but also ensure sustainable growth, a key goal for businesses aiming to scale.

4. Accounts Receivable Turnover

This metric measures the efficiency with which your business collects payments from customers. A high turnover rate indicates that your customers are paying on time, which keeps your cash flow steady and your financial health secure.

How to Measure It:

• Accounts Receivable Turnover = Net Credit Sales ÷ Average Accounts Receivable

Improvement Tips:

• Offer incentives for early payments, like slight discounts for paying invoices within a week.

• Automate invoicing and follow-up tasks to streamline the collection process.

• Establish clear payment terms upfront to avoid confusion.

Effective accounts receivable management ensures that your business has the funds to cover expenses without resorting to borrowing or dipping into reserves.

5. Year-Over-Year (YoY) Growth Rate

YoY growth measures your revenue growth compared to the same period in the previous year. This metric provides a clear picture of whether your business is expanding, contracting, or stagnant.

How to Calculate It:

• YoY Growth (%) = [(This Year’s Revenue - Last Year’s Revenue) ÷ Last Year’s Revenue] × 100

Staying consistent with a positive YoY growth rate demonstrates financial health and can help you gain investor confidence. To maintain steady growth, consider the support of fractional CFO services, which bring professional oversight to your forecasting and help align growth with your business goals.

How to Stay on Top of the Numbers

Tracking these metrics is critical, but managing them solo can be overwhelming. This is where professional guidance comes in. Utilizing CFO advisory services gives you access to expert insights that improve decision-making, identify trends, and strengthen your financial strategy. These specialists take the guesswork out of forecasting and ensure you’re prepared to handle any challenges that arise.

Remember, staying on top of your metrics is all about giving your business the tools it needs to succeed, scale, and thrive.

Monitoring your finances should never feel like a burden, especially when it’s the key to building a successful business. By keeping a close watch on these five metrics—cash flow, profit margins, CAC, accounts receivable turnover, and YoY growth—you’ll be well-equipped to stay ahead of the curve.

Make reviewing your numbers a regular habit, and don’t hesitate to seek expert bookkeeping advice. These actions can give you greater clarity and peace of mind as you plan for long-term business growth.

Simplifying Back Office Operations

It all begins with an idea.

Running a business is rewarding, but let's face it, it’s not always smooth sailing. The paperwork, payroll, taxes, and endless administrative tasks can pile up quickly, leaving you feeling stretched thin. That’s where back office services come in. By outsourcing these essential but time-consuming tasks, you can focus on what you do best—growing your business.

But how, exactly, do back office services make such a big difference? And why are so many business owners turning to back office solutions and back office technology to manage their day-to-day?

Let’s take a look!

How Back Office Solutions Help Businesses

Back office services do more than just handle busywork. They create a system of checks and balances in the workplace, setting up controls that minimize costly errors. For example, outsourcing back office tasks has been shown to reduce operational costs by roughly 27%. That’s a significant savings that can be reinvested into your business.

Not only are mistakes reduced, but back office services also streamline your workflows, helping everything run more smoothly. Whether it’s payroll management or compliance tracking, these behind-the-scenes operations work to keep your business on track.

7 Ways Back Office Services Simplify Your Day-to-Day

Here’s a closer look at how back office services take the weight off your shoulders.

1. Streamlining Payroll Management

Managing payroll can feel like a never-ending chore. Back office providers ensure employees are paid on time and taxes are calculated properly. With the support of a back office team, you can stress less over deadlines or compliance issues.

2. Simplifying Bookkeeping

Accurate financial records are critical, but they’re often hard to keep up with. Back office technology automates much of this process, while experts review and manage your books, making sure everything checks out and is up-to-date.

3. Reducing Tax Season Stress

Taxes are a headache for many business owners. Back office services help you stay tax-ready all year long by organizing records and preparing filings. When tax season hits, you won’t have to scramble to track down receipts or balance your books.

4. Optimizing Accounts Payable and Receivable

Cash flow can make or break a business. A solid back office system ensures invoices are processed promptly, payments are collected on time, and vendors are paid without a hitch. Smooth accounts payable and receivable management keeps your money moving where it needs to go.

5. Maintaining Compliance with Regulations

From new tax laws to data privacy rules, staying compliant can feel overwhelming. Back office experts stay on top of regulatory changes so you don’t have to. They make sure your business follows the law, reducing risks and penalties.

6. Providing Real-Time Financial Insights

With advanced technology at your fingertips, you can access up-to-date financial data whenever you need it. These real-time insights help you make well-informed decisions, whether you're creating a budget or planning your next big move.

7. Freeing Up Valuable Time

Here’s the big one. By outsourcing your back office tasks, you free up a significant portion of your day. Recent studies suggest that an average entrepreneur spends 36% of their entire work week on administrative tasks.

For a typical 40-hour business week, that’s almost 15 hours per week, that could be saved by moving administrative tasks to a skilled back office team. That’s valuable time you can spend driving growth and achieving your goals.

Why Back Office Services Are the Smart Choice

At the end of the day, back office services are about making your life easier. From improving accuracy to saving time, these services allow you to focus on what matters most.

Easy ways to leverage AI

It all begins with an idea.

Do not just work harder—work smarter. AI tools are transforming how businesses operate, saving time and boosting accuracy. Here are easy ways to leverage AI to take your operations to the next level.

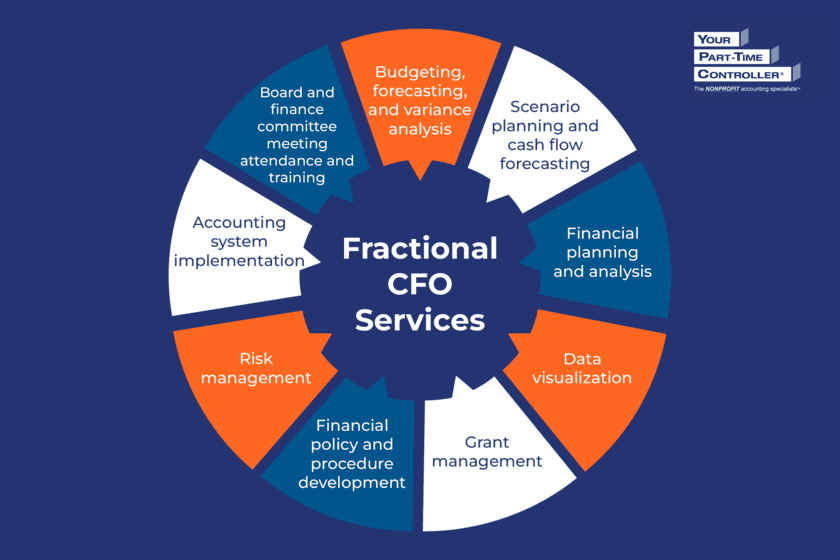

CFO advisory services

It all begins with an idea.

90% of startups fail, and financial mismanagement is one of the leading reasons.

Successful startups need more than big ideas. They require strategic financial planning to thrive. With CFO advisory services, startups can build solid financial foundations, optimize cash flow, and create long-term growth strategies.

Don’t just beat the odds—redefine them! Learn more about how CFO advisory services can help you scale your growing business: https://rebrand.ly/m24lx92